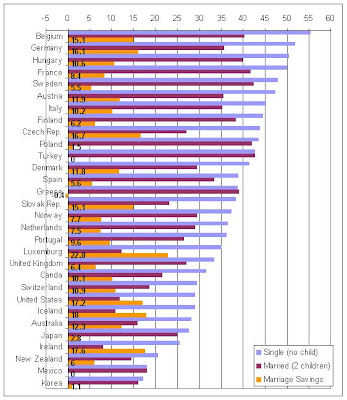

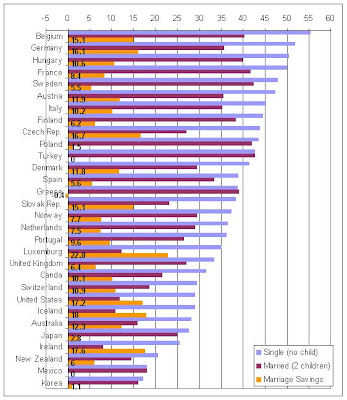

Looking for a job is quite time consuming. Once you have singled out the jobs and places you are most interested in, you do your best to actually get an offer. And then you will be confronted with a number which is your annual gross salary. Apart from the exchange rate adjustment, and the adjustment for the respective price level an important difference is the gap between net and gross around the globe. The OECD collects data on taxes and social contributions which they use to calculate the tax wedge. While the exact difference between gross and net will depend on the wage and other things, the measure gives an indication about the potential difference across countries. It does not come as a surprise that Germany and Belgium perform much worse than say Switzerland or the US (things in Ireland might change...).

What is more striking is the respective change in the tax wedge once you marry and have children. Suddenly, Germany and Belgium do not seem to be that bad of a place anymore while things in France and Sweden change only marginally. Interestingly, most emerging markets do not discriminate that much and Greece confirms its rather odd ideas about how to design policies by favoring singles over couples with children. On the other hand the government of Luxembourg rewards your marriage with a salary increase of more than 20%! It would be interesting to see how many Belgian singles actually try to find a man/woman and a job in Luxembourg. The incentives are quite high since not only gross salaries are higher but you can increase your salary by over 30% even if your gross salary remains unchanged.

What is more striking is the respective change in the tax wedge once you marry and have children. Suddenly, Germany and Belgium do not seem to be that bad of a place anymore while things in France and Sweden change only marginally. Interestingly, most emerging markets do not discriminate that much and Greece confirms its rather odd ideas about how to design policies by favoring singles over couples with children. On the other hand the government of Luxembourg rewards your marriage with a salary increase of more than 20%! It would be interesting to see how many Belgian singles actually try to find a man/woman and a job in Luxembourg. The incentives are quite high since not only gross salaries are higher but you can increase your salary by over 30% even if your gross salary remains unchanged.

What is more striking is the respective change in the tax wedge once you marry and have children. Suddenly, Germany and Belgium do not seem to be that bad of a place anymore while things in France and Sweden change only marginally. Interestingly, most emerging markets do not discriminate that much and Greece confirms its rather odd ideas about how to design policies by favoring singles over couples with children. On the other hand the government of Luxembourg rewards your marriage with a salary increase of more than 20%! It would be interesting to see how many Belgian singles actually try to find a man/woman and a job in Luxembourg. The incentives are quite high since not only gross salaries are higher but you can increase your salary by over 30% even if your gross salary remains unchanged.

What is more striking is the respective change in the tax wedge once you marry and have children. Suddenly, Germany and Belgium do not seem to be that bad of a place anymore while things in France and Sweden change only marginally. Interestingly, most emerging markets do not discriminate that much and Greece confirms its rather odd ideas about how to design policies by favoring singles over couples with children. On the other hand the government of Luxembourg rewards your marriage with a salary increase of more than 20%! It would be interesting to see how many Belgian singles actually try to find a man/woman and a job in Luxembourg. The incentives are quite high since not only gross salaries are higher but you can increase your salary by over 30% even if your gross salary remains unchanged.

1 comment:

dont tell me u are now making all these calculations to decide where to go work! or when to get married!

Post a Comment